For years, since top-ups were introduced in Pakistan, retailers have kept five different mobile phones to top-up mobile accounts of consumers. On top of keeping five separate phones, which is a hassle in itself, they maintain separate mobile-balance in all phones to keep their top-up business running. This Rs. 500 billion an year market is going to change now. Keep reading to know the how part.

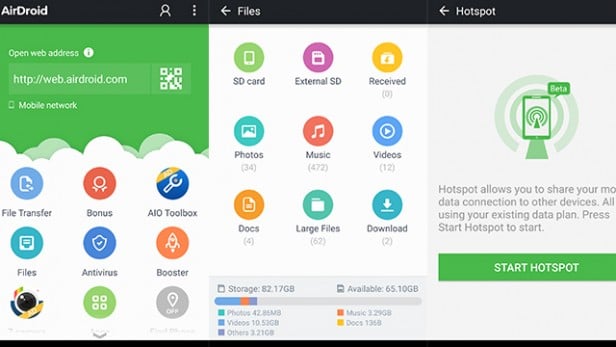

OneLoad, a Systems Limited company, has introduced one single platform — a mobile app as well as a web portal –through which retailers will be able to top-up any mobile number of any mobile phone operator, i.e. a single device and a single universal balance to top-up mobile phone customers of any operator.

So instead of keeping Rs. 5,000 balance in all five mobile phones separately with a constant fear of running out of balance for one operator (say for Ufone) while still having tons of balance for two operators (say Warid and Zong), retailers will have an option of keeping, say 20,000 universal mobile-balance in one account with which they can top-up any number of any mobile operator.

Additionally, retailers can also use this same OneLoad universal balance to issue scratch cards to consumers (who don’t want to give away their numbers for top-ups).

In addition to retailers, consumers can also have (a retailer like) account with which they can load mobile balance into any number of any mobile company.

Service Charges

- Opening an account with OneLoad is absolutely free.

- Getting cash into OneLoad from UBL Omni or Bank Alfalah is free of charge

- Paying bill is free of charge

- Topping up a mobile number is also free, but government taxes will be deducted (as they do with every load)

Benefit for Retailers

Other than maintaining a single universal account for top-ups of all mobile operators, OneLoad promises following benefits for retailers

- Market standard commissions rates or very close to market standard rates

- No paper work required to maintain a retailer account

- No physical presence (or store) required, even a Rickshaw wala can have a OneLoad retailer account and start topping up mobile balance or accept bill payments to earn commissions

How to Sign-Up with One Load

- In order to get a OneLoad account — that you can operate online or on smartphones through Android and iOS apps, simply head to their website here to fill up a simple form to register for an account.

- Alternatively you can download One Load Android or iOS apps and sign up for an account through their apps.

- Retailers can sign up from this link

Once you have an account, which is free to maintain, you can simply load balance into your OneLoad account through any UBL Omni shop or Bank Alfalah and start topping up the numbers.

OneLoad, still in beta, is in process of partnering with channel partners; after which consumers will be able to load their OneLoad accounts through any bank, via ATMs, online banking or through Credit and Debit Cards online.

Service Mechanics

- Download “OneLoad App”

- Sign-up for a “OneLoad” account

- Load balance in your “OneLoad” account through UBL Omni outlets or Bank Al Falah (More channels to be added soon)

- Use this “OneLoad” balance to top-up any number, pay bills, buy vouchers etc.

More Than Just Top-Ups

Mobile top-up is just one small thing that OneLoad does. Additionally, with your OneLoad universal balance, you can pay all sorts of utility bills, buy internet vouchers (for services like NetFlix, Facebook ads, Glit, Play Store, Hulu, iTunes, Amazon, Steam etc.), and transfer load to other OneLoad accounts.

Bus tickets and Cinema tickets are on the cards as well.

Muhammad Yar Hiraj, CEO of OneLoad, while speaking with ProPakistani, told me that his company is actively looking at remittances services as well and they may offer funds transfer services very soon.

“While SBP is working hard on interoperability, we would love to enable our customers to be able to transfer funds to any of mobile or conventional bank account”, said Mr. Hiraj.

It bears mentioning that OneLoad is an indigenous solution and System Limited is in fact aiming to implement this model in other countries as well.

Ref: ProPakistani